Black Friday 2024 Trends: Maximize Sales with BNPL, PriceMole Dynamic Pricing & Competitor Monitoring

Is Buying Now and Paying Later Worth It? Absolutely, yes! With Black Friday, one of the year’s biggest shopping events, fast approaching, e-commerce and retail businesses, especially Shopify Plus merchants, are gearing up to seize the moment. This season, the rising trend of Buy Now, Pay Later (BNPL) options is a game changer.

This innovative payment method resonates with budget-conscious shoppers eager to maximize their holiday spending. By enabling customers to stretch their budgets further, BNPL empowers them to purchase higher-value items without the immediate financial burden, providing a sense of financial security and control. For e-commerce and Shopify Plus stores, integrating BNPL with dynamic pricing and competitor monitoring strategies through PriceMole can create a compelling competitive edge.

What is Buy Now, Pay Later (BNPL)?

BNPL, or Buy Now, Pay Later, is a flexible payment option that allows customers to make purchases and pay for them over time, typically with low or no interest. This means that customers can buy a product now and pay for it in installments over a period of time, rather than paying the full amount upfront. This option is particularly appealing to younger shoppers who prefer to spread out their expenses, making larger purchases more manageable, especially during high-spending events like Black Friday.

The USA's Buy Now, Pay Later (BNPL) market is projected to grow by 14.8% annually, reaching approximately $109 billion in 2024. The medium to long-term outlook for the BNPL industry remains robust, with a compound annual growth rate (CAGR) of 9.5% expected from 2024 to 2029. By 2029, the gross merchandise value of BNPL is anticipated to rise from $94.94 billion in 2023 to $171.59 billion.

Nearly 1 in 5 American consumers used Buy Now, Pay Later (BNPL) in 2023, primarily for smaller transactions with an average loan size of $135. On average, BNPL users have borrowed $2,085 across all their purchases, with the typical transaction requiring a 25% down payment and offering 0% interest over a six-week repayment period.

"Waste neither time nor money, but make the best use of both" - Benjamin Franklin.

The BNPL industry in the United States is expanding rapidly, fueled by increased consumer adoption. This trend will continue this year as shoppers increasingly turn to installment payment options to manage their purchases amid rising inflation. The growing popularity of BNPL is also attracting more players to the market with their offerings.

Top Players in the BNPL Market

1. Klarna

- Dominant in Sweden with 25,900 merchants by February 2024.

- Accounts for 98% of Swedish domains offering BNPL options.

- Stronger relative use in Europe than in the U.S. and UK, favoring traditional card networks.

2. Affirm

- The leading BNPL option is in North America, particularly the U.S. and Canada.

- Over 560 Canadian merchants using Affirm by February 2024, representing 8% of Canadian domains with BNPL options.

3. Afterpay

- It is popular in Australia and New Zealand, with nearly 5,000 New Zealand merchants featuring it on their websites by February 2024.

- Comprises over 50% of all domains in New Zealand offering BNPL options.

- Despite high usage in the U.S., its market share remains higher in Australia and New Zealand.

4. PayPal’s Pay in 4

- They are gaining traction in France, with about 315 merchants offering it by February 2024.

- Represents nearly 8% of French domains with BNPL options.

5. Sezzle

- Significant presence in India, holding over 27% of the market until 2024.

- Over 2,500 Canadian merchants use Sezzle, accounting for nearly 40% of Canadian domains with BNPL options.

6. Zip

- They are widely used in Australia and New Zealand, with over 390 merchants in New Zealand by February 2024.

- Represents around 4% of all New Zealand domains offering BNPL options.

- These companies illustrate the strong global presence and market penetration of BNPL services, continuing to shape the industry's landscape.

Source: nimbleappgenie.com

Benefits of BNPL for Black Friday

1. Increased Cart Size and Enhanced Conversion Rates

Buy Now, Pay Later (BNPL) options significantly influence shopping behavior by encouraging consumers to purchase more, as they don't have to pay the total amount upfront. This flexibility often results in higher cart values and increased revenue for e-commerce and retail businesses—especially Shopify Plus merchants.

Research from Zip shows that merchants offering installment plans can see a 20-30% increase in cart conversions. This boost is particularly beneficial for customers who might have abandoned their carts due to high upfront costs, allowing them to complete their purchases. As a result, BNPL facilitates larger single purchases and enhances customer lifetime value.

Over time, additional sales from recovered abandoned carts and larger order sizes accumulate as merchants refine their installment offerings to align with customer purchasing behaviors. Strategic installment options balance affordability for consumers while meeting revenue goals for e-commerce and Shopify Plus merchants, ultimately driving up average order values. This strategic advantage of BNPL for Black Friday makes the audience feel competitive and prepared for the event.

2. Attracting New Shopper

BNPL attracts price-sensitive consumers who may have been hesitant to shop on Black Friday. By offering BNPL, e-commerce, and Shopify Plus, can reach a new customer segment that appreciates the ability to pay over time. This method is especially appealing to consumers wary of credit cards and debt, allowing them to make purchases without impacting their credit scores. This inclusivity and customer-focused approach make the audience feel valued and integral to the business strategy.

Source: vodeno.com

3. Competitor Monitoring

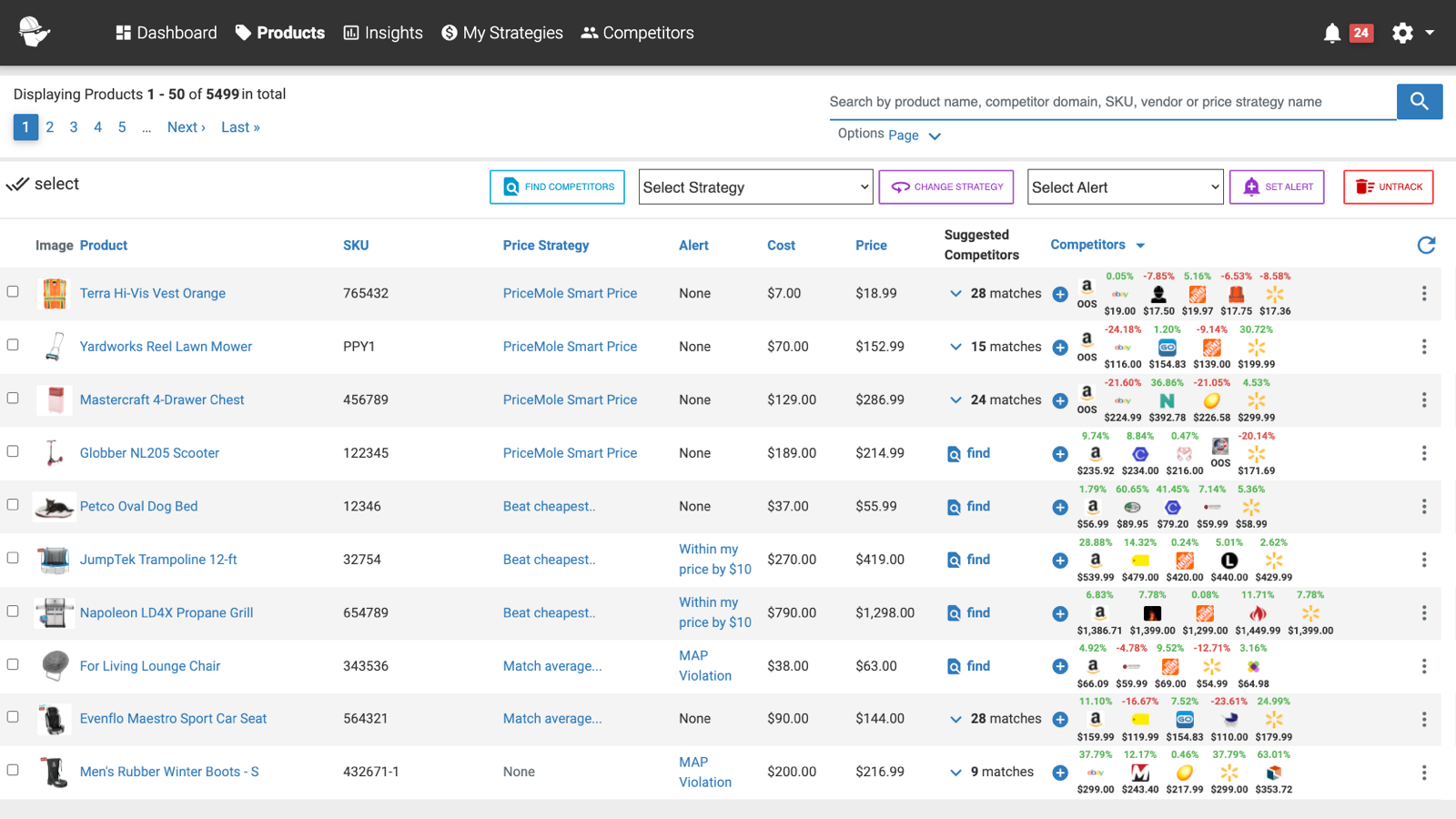

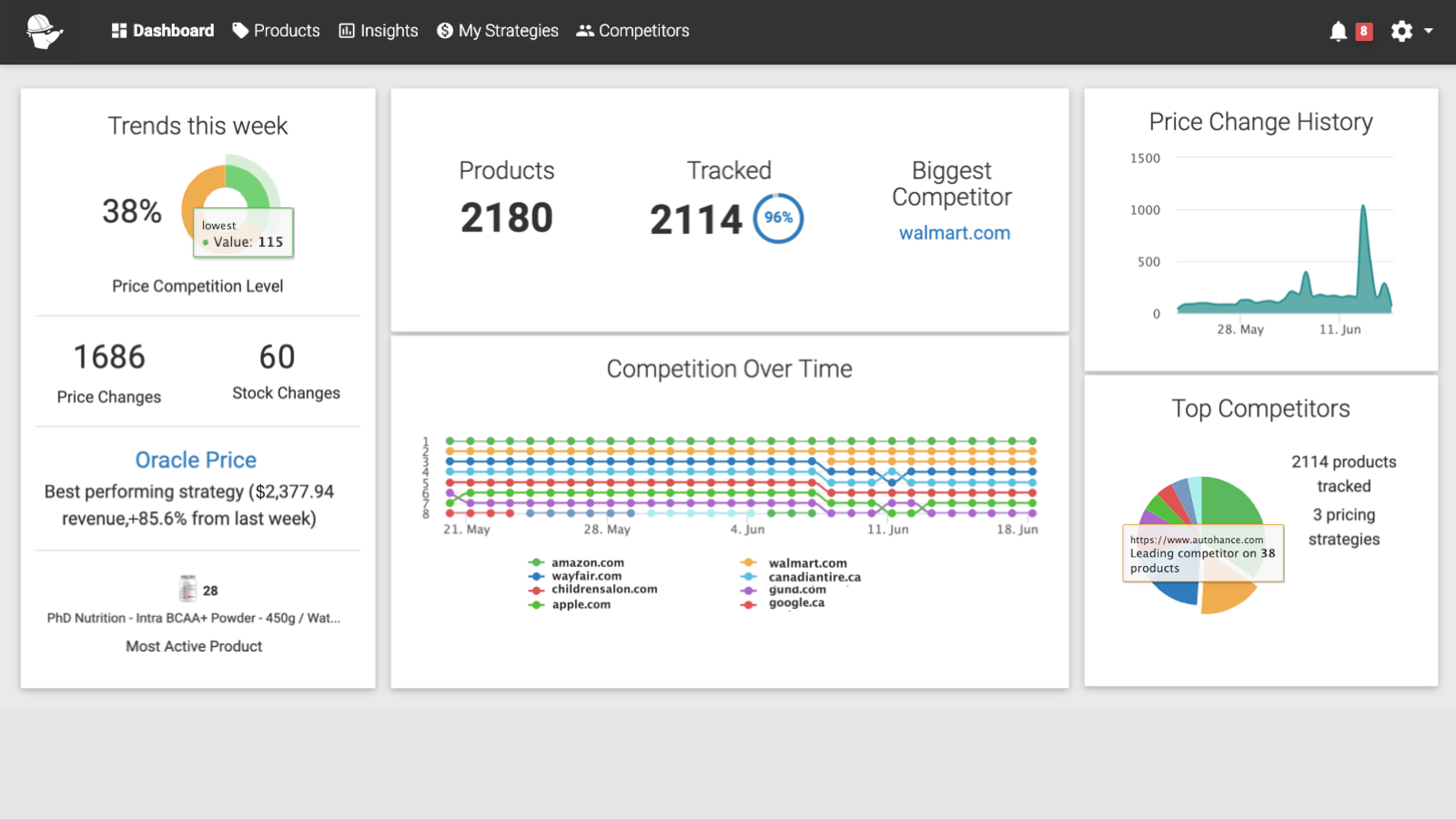

PriceMole provides real-time insights into your competitors' strategies, allowing you to stay ahead in the competitive landscape of Buy Now, Pay Later (BNPL) offerings by monitoring price fluctuations, product availability, and promotional tactics. For instance, if a competitor runs low on stock for a popular product, you can strategically adjust your pricing while incorporating attractive BNPL options to entice customers. This proactive approach ensures you maintain a competitive edge and capitalize on market opportunities, particularly during high-demand periods.

4. Dynamic Pricing

Preparation is essential to succeed on Black Friday, and utilizing PriceMole significantly enhances your strategy. By implementing automated Pricemole Dynamic Pricing strategies alongside the BNPL (Buy Now, Pay Later) option, you can respond immediately to competitor actions, ensuring your prices remain attractive and competitive throughout the event.

With the PriceMole Competitor Widget, you can empower your customers to shop confidently! They no longer need to shop around and compare prices. The PriceMole app guarantees they will always get the best price available. This combination of dynamic pricing and BNPL offers customers greater flexibility, encouraging them to make larger purchases while helping your e-commerce or Shopify Plus stores maximize sales potential during one of the year's busiest shopping days. Embrace these tools to adapt to market fluctuations and improve customer appeal.

Summary

Incorporating BNPL, PriceMole’s Competitor Monitoring, Dynamic Pricing, and Competitor Comparison Widget into your Black Friday strategy can create a powerful approach to attract and retain more customers while boosting profits. For Shopify Plus and e-commerce merchants, leveraging flexible payments, competitive pricing, and real-time adjustments helps capture a wider audience and maximize sales this Black Friday season.

Special Campaign!

Ready to take your store’s potential to the next level this Black Friday? For a limited time, get 50% off credit for your first two months as a new PriceMole partner when you upgrade today! Don’t just follow trends—take control and watch your sales soar.

Discover how PriceMole’s powerful tools can transform your Black Friday pricing strategy. Visit us on our Website, Shopify, BigCommerce, Facebook, Twitter, and LinkedIn to learn more.

Contact us now to gear up for a record-breaking Black Friday—let’s make this season your best one yet!